Retirement

California Public Employees’ Retirement System (CalPERS)

An employee who becomes a “new” member of CalPERS for the first time on or after January 1, 2013 (and who was not a member of another California public retirement system prior to that date) will be enrolled in the CalPERS 2.0% @ 62 benefit formula with a three-year final compensation in accordance with Public Employees’ Pension Reform Act of 2013 (PEPRA). New members (PEPRA) will be required to pay half of the normal cost [Govt. Code Section. 7522.30(c)] currently 6.25% of eligible earnings toward the employee contribution.

An employee who is a “classic” member of CalPERS, or a current member of another California public retirement system, who is hired on or after January 1, 2012, will be enrolled in the CalPERS 2.0% @ 55 benefit formula with a three-year final compensation. Classic members shall contribute 7% of eligible earnings toward the employee contribution.

Social Security/Medicare

Along with CalPERS retirement, the Agency also participates in Social Security and Medicare. The Agency pays 7.65% on your behalf [6.2% Social Security + 1.45% Medicare], and the employee pays 7.65% via payroll taxes.

Medical

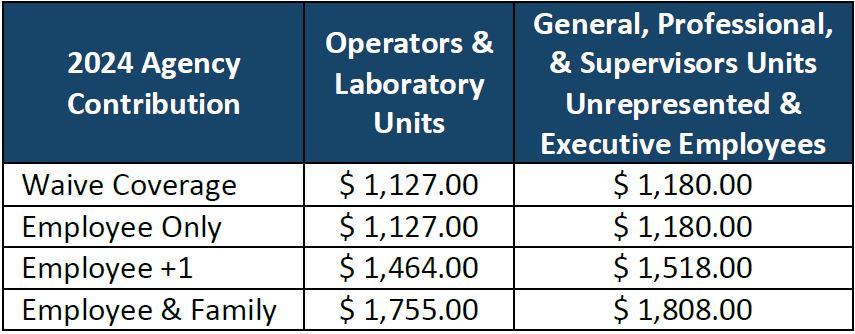

The Agency shall make a maximum monthly contribution towards the cost of his/her health insurance as follows:

Health insurance is offered through CalPERS, and enrollment is optional with evidence of health coverage from another source. Eligible employees who waive their medical benefit receive a cash incentive payment. Coverage is effective the first day of the month following enrollment.

Dental and Vision Insurance

The Agency offers two dental plans – Delta Dental (PPO) and Western Dental (DPO). Enrollment in one of the plans is mandatory. Coverage is effective the first day of the month following enrollment.

Vision insurance is offered through EyeMed Vision Plan and enrollment is voluntary. Coverage is effective the first day of the month following enrollment.

Flexible Spending Account (FSA) Plan

Upon completion of six months of employment, employees may participate in the Agency’s Section 125 Cafeteria Program. Participants in this program may take advantage of tax savings offered through a medical care flexible spending account, a dependent care flexible spending account, or purchase supplemental benefits including critical illness and accident insurance with pre-tax dollars. In addition, employees can purchase supplemental life insurance with post-tax dollars.

Term Life and Accidental Death & Dismemberment (AD&D) Insurance

Life and AD&D insurance is offered through Cigna Life Insurance. Executive Management employees are provided with 1 time their annual earnings up to $300,000. Unrepresented Management employees are provided with an Agency paid $90,000 Life and AD&D policy. Unrepresented non-management, and members of the Supervisors’, Laboratory, Professional, General, or Operators’ Unit are provided an Agency paid $50,000 Life and AD&D policy. Enrollment into a basic $10,000 Life and AD&D policy is required and paid by the employee. Employees may purchase dependent life, for their spouse and/or eligible child(ren), or additional Life and AD&D coverage for themselves up to $500,000. Coverage is effective the first day of the month following date of hire.

Disability Insurance

Employees are insured by an Agency-paid long-term disability insurance, which will provide income for an employee who is totally disabled from illness, injury, or accident. The basic benefit provides for 60% of the first $10,000 of monthly salary, reduced by deductible income, after a 365-day waiting period. Coverage is effective the first day of the month following the date of hire.

Short-term disability insurance is available through State Disability Insurance (SDI). Employees covered by SDI are covered by two programs: Disability Insurance and Paid Family Leave. Per applicable MOU and/or Personnel Manual, cash-out option available.

Employee Assistance Program

Agency employees are provided access to an Employee Assistance Program (EAP) which provides 24/7 assistance needed to help resolve life’s challenges.

401(a) & 457(b) Deferred Compensation

Participation in a 457 deferred compensation plan is available through Empower Retirement. The Agency will contribute $25.00 per pay period to a single 457(b) account for each employee who has made an elective deferral of twenty-five ($25) or more to the plan. Also, participation in a 401(a) Defined Contribution Plan is available within 60 days of hire.

Flexible Work Arrangements

Whenever possible, the Agency strives to be flexible to help employees achieve a balance between work and home responsibilities. Most employees participate in a 4/10 work week.

Time Off

Holidays

The Agency offers nine (9) paid holidays. Additional paid floating holidays are available every fiscal year as follows:

- Executive Management: 6 Floating Holidays per FY & 6 Executive Leave days

- Unrepresented Management: 10 Floating Holidays per FY

- Unrepresented Non-Management: 6 Floating Holidays per FY

- Supervisors’ Unit: 8 Floating Holidays per FY

- Laboratory Unit: 5 Floating Holidays per FY

- Professional Unit: 6 Floating Holidays per FY

- Operators’ Association:6 Floating Holidays per FY

- General Unit: 60 hours Floating Holidays per FY

Vacation Leave

Employees accrue 80 hours of vacation leave per year depending on length of employment, progressing to 200 hours per year. Executive Management employees accrue 120 hours of vacation leave per year depending on length of service, progressing to 240 hours per year. Per applicable MOU and/or Personnel Manual, cash-out option available.

Sick Leave

Employees accrue 96 hours of sick leave annually.

Miscellaneous

Vehicle Allowance

Executive Management and Unrepresented Management employees may receive a monthly vehicle allowance.

Educational Reimbursement Program

The Agency may reimburse eligible employees for the cost of educational courses up to $5,250 per fiscal year for the cost of educational expenses that are related to the employee’s work. Limited Term employees are not eligible for this benefit.

Safety Equipment Stipend

Members of the Laboratory Unit shall be provided with safety glasses. Payment shall be on a reimbursement basis, not to exceed $250 per fiscal year. Additionally, Laboratory members will receive $300 safety equipment stipend.

Professional Development Stipend

Employees not on original probation shall be entitled to a professional development stipend of one thousand dollars ($1000) per calendar year. The professional development stipend shall be paid every twenty-fifth (25th) pay period. Refer to specific MOU or Personnel Manual for details and payment information. Limited Term employees are not eligible for this benefit.

Wellness Program

Employees not on original probation shall be entitled to a wellness stipend of five hundred dollars ($500) per calendar year. The wellness stipend shall be paid every twenty-fifth (25th) pay period.

Computer Loan Program

Eligible employees may receive an interest-free loan up to $3,000 to purchase a personal computer. Limited Term employees are not eligible for this benefit.